Summary: The bond market has experienced notable fluctuations following the recent election win by former President Donald Trump. Investors are closely watching the potential implications of Trump’s economic […]

Labour’s Budget Causes Bond Market Turbulence

Summary: The recent budget announcement by the Labour government has led to significant turbulence in the UK bond market, with yields rising sharply due to increased borrowing and tax hikes. Expanded Version: Background: The Labour government’s recent budget announcement has caused a stir in the UK bond market. The budget includes substantial tax hikes and increased borrowing, aimed at funding various public spending initiatives. This has led to a sharp rise in yields on government bonds, known as gilts, causing concern among investors. Market Reaction: The yield on 10-year gilts has surged to levels not seen since the 2022 “mini-budget” crisis, reflecting investor apprehension about the fiscal policies. The increase in borrowing costs has also put pressure on the pound, which has depreciated against the US dollar. Economic Impact: Economists are divided on the long-term impact of the budget. While some believe the increased spending could stimulate economic growth, others are concerned about the potential for higher inflation and the sustainability of the debt levels. The Bank of England may need to reconsider its monetary policy stance in response to these developments. Expert Opinions: Financial analysts have highlighted the need for careful monitoring of the bond market and the broader economic implications of the budget. Some experts argue that the government’s fiscal policies could lead to higher interest rates and slower economic growth if not managed carefully. Future Outlook: The long-term effects of the budget will depend on how effectively the government can balance its spending plans with market expectations. Continued fiscal responsibility and clear communication with investors will be crucial to maintaining economic stability. Source: For more detailed information, you can read the full article here.

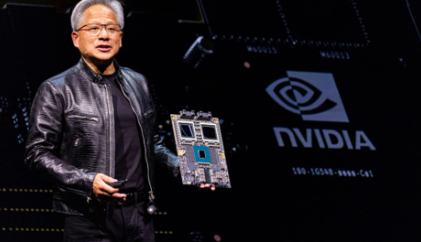

Nvidia closes at record as AI chipmaker’s market cap tops $3.4 trillion

Summary: Nvidia’s shares have reached an all time high, pushing the company’s market capitalization to a staggering $3.4 trillion. This surge underscores the growing demand for Nvidia’s innovative chip technology, which is pivotal in the realms of AI and computing. Suggestions to lengthen: Source: CNBC Article I hope this helps. If there’s anything specific you want to know more about, just say the word!

Key Insights Before Tuesday’s Market Opens

Paraphrased and Expanded Article: Key Insights Before Tuesday’s Market Opens As investors prepare for the trading day on Tuesday, several crucial factors are influencing market sentiment. Here are […]

Factors Behind Recent US Market Decline

Paraphrased and Expanded Article: On Monday, the US stock markets experienced a significant downturn, with multiple factors contributing to the negative sentiment. The Dow Jones Industrial Average fell […]

Stock Market Faces Crucial Inflation Test

Stock Market Faces Crucial Inflation Test The stock market’s recent rally is approaching a critical juncture as it faces the upcoming Consumer Price Index (CPI) inflation report. This […]

US Job Market Shows Mixed Signals Amid Fed Rate Decisions

US Job Market Shows Mixed Signals Amid Fed Rate Decisions the latest jobs report from the Bureau of Labor Statistics reveals a complex picture of the US economy. […]

Indian Funds Set Record in Buying Market Dip

Local funds in India have set a new record by injecting a substantial amount of capital into the stock market during a recent downturn. This surge in investment […]

China’s Stimulus Boosts Stock Market by 25%

China’s recent economic stimulus measures have led to a significant rally in the stock market, with the CSI 300 blue-chip index surging over 25% in just nine days. […]